Xoom vs Payoneer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-15 15:05:40.0 15

Introduction

With the growth of global trade and cross-border e-commerce, demand for international money transfers has increased. High fees, slow delivery, complex procedures, and hidden charges remain common challenges. Both Xoom and Payoneer offer convenient international transfer solutions. PandaRemit serves as another reliable option, providing fast, fully online transfers. For more guidance, see Investopedia International Money Transfer Guide.

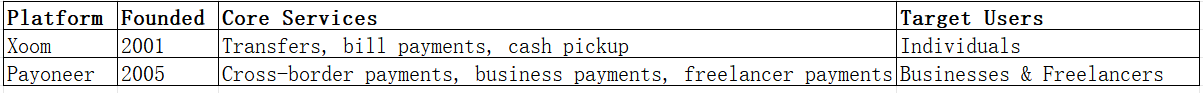

Xoom vs Payoneer – Overview

Xoom

-

Founded: 2001

-

Services: International transfers, bill payments, cash pickup

-

Users: Millions globally, covering 100+ countries

Payoneer

-

Founded: 2005

-

Services: Cross-border payments, business payments, freelancer payments

-

Users: Businesses, freelancers, cross-border e-commerce users

Similarities

-

Both provide international transfers

-

Mobile app accessibility

-

Support bank account linking and online payments

Differences

-

Fees: Xoom is suitable for small personal transfers; Payoneer caters to business and high-volume transactions

-

Features: Xoom supports cash pickup; Payoneer is business-oriented

-

Target users: Xoom for individuals; Payoneer for businesses and freelancers

PandaRemit offers a flexible, fast online transfer option.

Xoom vs Payoneer: Fees and Costs

-

Xoom: Fixed fees for small transfers; some countries offer discounts

-

Payoneer: Lower fees for business and freelancer accounts; small personal transfers may be slightly higher

-

Account types: Xoom requires no subscription; Payoneer business accounts receive fee advantages

Fee reference: Investopedia Transfer Fees Guide

PandaRemit can be a lower-cost alternative.

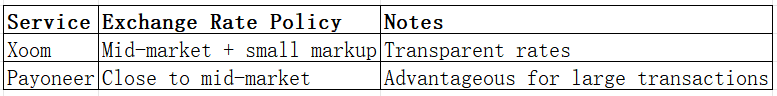

Xoom vs Payoneer: Exchange Rates

-

Xoom: Close to mid-market rates, small markup

-

Payoneer: Transparent rates, favorable for large business transfers

PandaRemit provides competitive rates without specifying exact figures.

Xoom vs Payoneer: Speed and Convenience

-

Xoom: Instant delivery for some countries, easy mobile operation, supports cash pickup

-

Payoneer: Usually 1-2 business days, supports cross-border business and freelancer payments

Speed guide: WorldRemit Transfer Speed Guide

PandaRemit offers a fast, fully online transfer experience.

Xoom vs Payoneer: Safety and Security

-

Xoom: Regulated in the U.S., uses encryption and fraud protection

-

Payoneer: Internationally regulated, secure platform

PandaRemit is a licensed and secure online transfer option.

Xoom vs Payoneer: Global Coverage

-

Xoom: 100+ countries, multiple payout methods including cash and bank

-

Payoneer: 200+ countries, mainly bank account payouts

Coverage reference: World Bank Remittance Coverage Report

Xoom vs Payoneer: Which One is Better?

-

Xoom Strengths: Best for small personal transfers, fast delivery, versatile services

-

Payoneer Strengths: Best for businesses and freelancers, competitive rates for large transactions

For users seeking fast and flexible online transfers, PandaRemit provides an excellent alternative.

Conclusion

Xoom and Payoneer each have strengths: Xoom suits small personal transfers, while Payoneer excels in business and freelancer large payments. PandaRemit serves as a compelling alternative, offering high exchange rates, low fees, flexible payment methods (POLi, PayID, bank transfer, e-transfer, etc.), coverage of 40+ currencies, and fast, fully online transfers. Learn more at PandaRemit Official Site or see Investopedia International Money Transfer Guide. Choosing the right platform depends on your needs, with PandaRemit providing an efficient and cost-effective cross-border transfer experience.